Unit05-B: Decentralization Reform and Property Tax in Japan: A Consideration of the Benefit Principle

Unit05-B: Decentralization Reform and Property Tax in Japan: A Consideration of the Benefit Principle

Tomomi Miyazaki

Associate Professor

Graduate School of Economics, Kobe University

1.The Benefit Principle of Property Tax

Some researchers have proposed that after the decentralization reform in Japan, property tax can be useful as fundamental tax for municipalities. For example, Ihori (2007) argues that a property tax could be employed as an effective tax under the decentralized society because it enables the benefit of local government public services to be reflected in a tax.

This argument presupposes that a property tax satisfies the benefit principle. According to the traditional view of the incidence of property tax, the burden of a property tax on land is borne fully by the owner of the land. If this is the case, then a property tax on land can be considered to satisfy the benefit principle. On the basis of this argument, Doi (2000) proposes that a property tax on land should be a fundamental tax for municipalities.

However, in actuality, a property tax is levied not only on land but also on houses and depreciable assets. This paper will provide an introduction to previous research concerning the relationship between decentralization and property tax and consider the problems of the current property tax system, and will conclude by offering a suggestion as to the best direction for the property tax system after the decentralization reform.

The benefit principle of property tax is explained by the benefit view on tax incidence. The benefit view states that while property tax increases the tax burden, this burden is offset by the benefits offered by public services financed by the tax. This proposition is explained using the example of rental properties. Let us assume that a property tax is levied on rental houses, and the tax revenue is used for the construction of a shopping mall operated by the local government. The construction of the shopping mall can be considered to make the local area more attractive, and thus to increase the asset value of residential properties. This is called “tax capitalization.” This capitalization offsets the decline in the landlord’s profit due to the levying of the tax. For the renter of the property, even if the rental fee increases as a result of the tax, the convenience thanks to the shopping mall will be considered to be worth an increase of this amount, or in some cases even more. The benefit view explains the offsetting of tax burden by the benefits received from public services in this way.

In research conducted in the US, Carroll and Yinger (1994) examined the benefit view via an analysis of 147 towns and districts in the Boston metropolitan area. They concluded that the owners of rental properties bear some tax burden in the form of a decline in their profit rate following the levying of the tax, and that as a result, the benefit view does not hold in the strict sense.

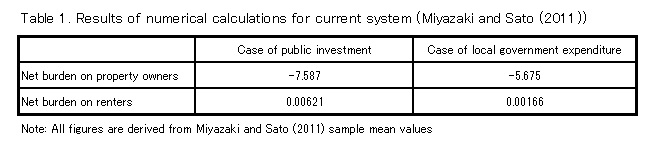

In Japan, Miyazaki and Sato (2011) studied the benefit view by means of an econometric analysis and simple calculations using data for 46 prefectures. Table 1 shows the results of the numerical calculations conducted in this research. The net tax burden on renters was 0.00621% in the case in which public investment is considered a municipal public service, and 0.00166% in the case in which local government expenditure is considered a public service. Both results are close to zero, suggesting that for renters, the benefit provided by public services adequately offsets the burden of the tax. By contrast, the figures for the net benefit received by property owners are both negative, indicating only a decline in the profit rate for property owners. This result indicates that because the capitalization touched on above is inadequate, under the present system the property tax is not a benefit tax for property owners.

2. Problems of the Existing Property Tax System

The following three factors can be considered as reasons why the current property tax system not a benefit tax.

First, local governments have not been granted complete authority in setting tax rates. The benefit view assumes that a municipality selects a tax rate that enables benefit to counterbalance the burden of the tax. In the case of Japan, the standard rate for property tax is set at 1.4%, and while municipalities have the right to impose a exceeded tax rate, etc., there is virtually no discretion for them to freely determine their own rate of property tax.

The second factor is whether or not the benefit from public services is appropriately reflected in market prices (land prices). When there is a gap between tax bases and market price, the capitalization mechanism does not function. The discussion of problems related to methods of assessment for land in the property tax bases relies chiefly on Sato (2011).

Land is revalued every three years; since 1994, the yardstick for the assessed value of land has been 70% of the declared land value. While the system attempts to a certain extent to reflect market prices, it also features a variety of preferential measures. For example, in the case of a small residence, the tax base is one-sixth of the assessed value. Taking these preferential measures into consideration, Nakano (2004) points out that the effective tax rate on land is low, in actuality only 0.098%. In the case of a normal housing lot with an area of over 200m2, the tax base is one-third of the assessed value. Preferential measures such as these reduce the burden of the property tax when land is owned for residence. The land zoned for business purposes can be between 60 and 70% of the assessed value 1)。

Turning to agricultural land, in the case of agricultural land located in urbanization control zones, which is in principle not to be used for development purposes or for the construction of city facilities, assessed values and tax bases are, in principle, equivalent to those for residential land, in particular within Japan’s three major metropolitan areas. However, in the case of normal agricultural land and agricultural land located in urbanization control zones other than those mentioned above, mechanisms including measures to ease the tax burden in response to the classification of the level of burden ensure that tax bases are discounted 2). As can be seen from the discussion above, as a result of various preferential measures, under the existing system tax bases are discounted.

The third of the reasons is the possibility that property tax might be considered a capital tax following a local public finance theory. Carroll and Yinger (1994) and Miyazaki and Sato (2011) indicate that the burden of the property tax extends to the supply side. Let me consider the levying of taxes on capital, in particular on residential building and other depreciable assets, based on the capital tax view. Assume a country made up of two regions: Region A, in which the tax rate is higher than the national average, and Region B, in which the tax rate is lower than the national average. First, the rate of return on investment for capitals temporarily declines in both regions due to taxation, and there is a flow of capital from region A to region B as a result of the tax rate gap (an excise tax effect). Next, due to over-supply in region B as a result of the capital inflow, the post-tax rate of return on capitals in region B declines further, to a level lower than that resulting from the excise tax effect (this is a profit tax effect). If capital tax view is assumed to be correct, then a property tax can be interpreted as a capital tax rather than a benefit tax. Miyazaki and Sato (2013) examined the capital tax view with a focus on residential building, and found that the property tax is incident on the owners of capital. The empirical results produced by Miyazaki and Sato (2013) suggest that the current property tax may have an aspect as a capital tax.

1)See Research Center for Property Assessment System (Ed.) (2015), etc.

2)http://www.maff.go.jp/j/keiei/koukai/nouchi_seido/pdf/hoyuu_zeisei.pdf (in Japanese).

3. Property Tax under Conditions of Greater Local Government Autonomy

Section 2 above indicated the possibility that Japan’s current property tax is not a benefit tax based on three factors: (1) Municipal governments possess only limited rights to determine the taxation rate; (2) There is a gap between tax bases and market prices as a result of various preferential measures; and (3) The inclusion of capital as an object of the tax makes it, for practical purposes, a capital tax. Below, I would like to make some suggestions for property tax after the decentralization reform.

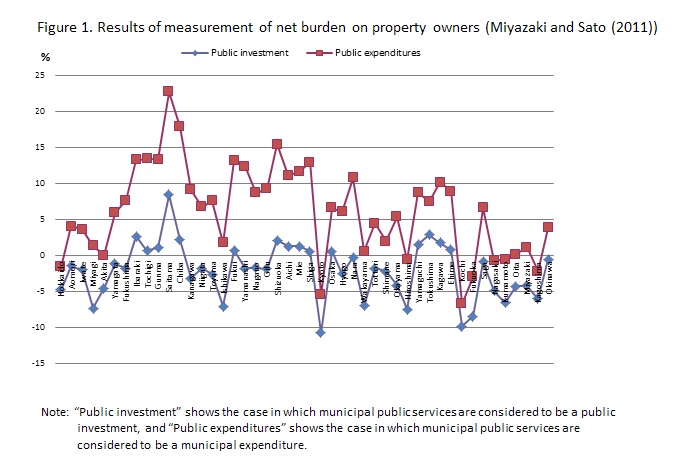

First, after the decentralization reform, it would be necessary to grant municipalities complete discretion in deciding tax rates. Miyazaki and Sato (2011) also conducted numerical calculations for a case in which municipalities possess complete discretion in setting tax rates under decentralized society. In this case, property tax revenues and the provision of public services are completely linked. The results are shown in Figure 1. The net burden on property owners is close to zero in most regions, as a result of the offsetting of the decline in the profit rate due to the property tax by the benefit received from public services.

However, if the various preferential measures causing taxation standards to diverge from market prices and the differences in assessment methods for land being used for different purposes were to remain in place, even if local governments were granted the right to set tax rates, the benefit received from pubic services would not be adequately reflected in land prices. Because of this, the property tax would not function exclusively as a benefit tax even in the decentralized society. In order for the property tax to function as a benefit tax, it will be necessary to grant municipalities the right to set property tax rates, at the same time as eliminating preferential measures from the tax bases. Sato (2011) points out that it would be desirable for the measures to be reflected in the tax rate so that preferential measures are in effect. This goal would be realized if municipalities are granted complete discretion in setting tax rates under the decentralized society.

In order to make it possible to realize operation of local government finances situated in a direct relationship with residents, it will be necessary to awaken an consciousness of costs in those residents and spur an interest in the management of local finances, by granting local governments complete freedom in setting the tax rate and eliminating preferential measures from the taxation standards, rendering the link between property tax and public services transparent.

Turning to other objects of taxation, in the case of depreciable assets, as suggested by Sato (2011), it will be necessary to avoid incentives to tax competition or tax exporting. It will also be necessary to reform the property tax on residential building, which Miyazaki and Sato (2013) showed to function as a capital tax. As discussed above, Miyazaki and Sato (2011) consider that a tax on residences, including rental houses, could satisfy the benefit principle after the decentralized reform. However, taking the effect of the distribution of resources into consideration, the abolition of a tax on residential building with accompanying the revenue neutrality by increasing the burden of tax on land, as proposed by Yamazaki (2011), also represents another option.

<Reference>

- Toshihiro Ihori (2007) ‘Chiisana seifu’ no otoshiana: itami naki zaiseisaiken rosen wa kiken da (Traps of “small government”: Danger in policies of fiscal reform without pain (in Japanese)), Nikkei Publishing Inc.

- Motohiro Sato (2011) Chihozei kaikaku no keizaigaku (Economics of Local Tax Reform (in Japanese)), Nikkei Publishing Inc.

- Takero Doi (2000) “Chihokofuzei no mondai to sono kaikaku (Issues and reforms of local allocation tax (in Japanese)),” Ekonomikkusu: economics & policy, 3, pp.70-79, Toyo Keizai Inc.

- Hideo Nakano (2004) “Koteishisanzei kaikaku to tochi/juutaku shijo (Property tax reform and land & housing market (in Japanese),” Finance, June 2004, pp. 64-70.

- Tomomi Miyazaki and Motohiro Sato (2011) “Is Property Tax a Benefit Tax? The Case of Japanese Regions (in Japanese),”Economic Analysis, No.184, pp.99-119.

- Tomomi Miyazaki and Motohiro Sato (2013) “Is the Property Tax a Capital Tax? An Investigation of the ‘Capital Tax View’ of the Property Tax (in Japanese),” The Economic Review, Vol.65, No.4, pp.303-317.

- Fukuju Yamazaki (2011) “Shijo-mekanizumu wo tsujita hisaichi no kon-nan to fukko kosuto no kyoyu (Sharing difficulty and recovery costs at disaster affected areas using a market mechanism (in Japanese)),” S. Ito, M. Okuno, T. Onishi and M. Hanazaki (eds.), Higashinihon daisinnsai fukkou heno teigen: jizoku kanou na keizaishakai no kouchiku (Proposals for recovery from the Great East Japan Earthquake: Building a sustainable economy/society (in Japanese)), University of Tokyo Press, pp.264-270.

- Carroll, R. J. and J. Yinger (1994) “Is the Property Tax is a Benefit Tax? The Case of Rental Housing,” National Tax Journal 47 (2), pp.295-316.