Unit 01-B: Health Care, Long-term Care, and Local Public Finances

Unit 01-B: Health Care, Long-term Care, and Local Public Finances

Masayoshi Hayashi

Professor

Faculty & Graduate School of Economics, University of Tokyo

1. Introduction

Local governments form an integral part of the Japanese system of health and long-term care for the elderly. While the central government designs the care system, local governments play other important roles. In particular, municipalities (cities, towns, and villages) manage National Health Insurance (NHI) programs and Long-term Care Insurance (LTCI) programs for their elderly residents, with total budgets of 9.7 and 8.1 trillion yen respectively in 2012. Municipalities also conduct eligibility assessments for LTCI benefits and control the supply of LTC services. In addition, all the municipalities within a given prefecture form an administrative unit that finances the costs of medical benefits for those aged 75 and above (the cohort known as “old-old”). This short paper, focusing on the NHI and LTCI, provides background information concerning the role of local government in financing health and long-term care for the elderly in Japan, and briefly discusses some of the issues that these systems are facing. These issues include compromised horizontal equity among municipalities, potential failure to pool risks within municipalities, and possible adverse incentives for municipalities to ration social services that may result in inefficient allocation of social service resources.

2. National Health Insurance: Description of the System and Current Issues

2.1. Health Care Benefits Provision in Japan

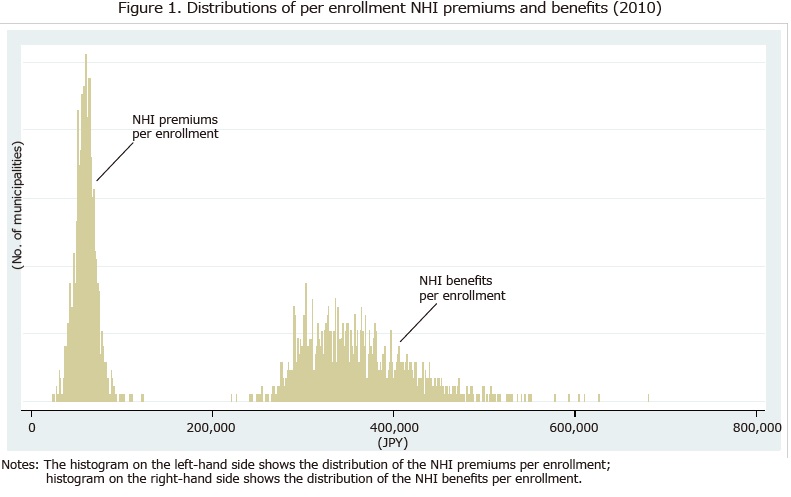

Different public health insurance programs finance Japan’s standardized and uniform system of public health insurance benefits. Table 1 summarizes these programs. The benefits side of the public health care system is universal and uniform. The system provides the entire population with standardized benefits that cover wide ranges of medical services and prescribed drugs. Patients are free to choose any health care service provider. With some exceptions, co-payments and coverage for services are identical regardless of the type of provider (clinic or hospital, private or public). This also applies to prescribed drugs. The co-payment rate is 30 percent, with reductions for the elderly with incomes below a specific threshold: 20 percent for those aged 70-74 and 10 percent for those aged 75 and above. In addition, there are ceilings on co-payments for catastrophic expenditures.

In standard cases, providers receive payment for the healthcare services and prescribed drugs they provide (i.e., retrospective payment). Following the fee schedule the central government sets, they collect co-payments directly from their patients, and receive reimbursements for the residual costs from insurers. The insurers finance the reimbursed portion of the medical expenses, i.e., the insurance benefits.

2.2. How Are the NHI Programs Financed?

The NHI is a residence-based insurance scheme managed by municipalities acting as insurers. Residents of the municipality who are excluded from Employees’ Health Insurance (EHI) programs are enrolled in the NHI program. These typically include the unemployed, the self-employed, farmers, and employees of smaller firms and their families. Individuals enrolled in the NHI pay premiums to the municipality in which they reside. The premium schedule consists of several components. The central government sets the menu for these components, and premiums depend on household income, assets, and size. However, the menu is also broad enough to allow municipalities to establish their own premium schedules.

Elderly citizens aged 65-74 (the cohort known as “young-old”) represent about 30 percent of total NHI enrollments. Because this stratum tends to have more medical needs and earn less than the younger working population, Japan’s elderly are placing fiscal stress on municipal NHI finances. A high proportion of the unhealthy leads to an increase in medical needs, while a high proportion of the poor results in a decline in premium collections due to reductions in premiums for low-income households.

Layers of transfers of funds therefore help municipalities finance their NHI benefits. First, there are two schemes of nation-wide cost sharing which in effect transfer funds from EHI programs to NHI programs. One scheme, known as the Expense Grant for the Young-Old (EGYO), addresses medical costs for citizens aged 65-74. Because the majority of those aged 65-74 are enrolled in the NHI, municipalities receive net transfers from this cost-sharing scheme. Another scheme also transfers funds from EHI programs to the NHI to cover benefits for individuals who have transferred from EHI programs due to having retired before the age of 65.

Second, a prefecture-wide scheme, the Collective Stabilization Program (CSP), equalizes and stabilizes municipal revenue streams. The CSP disburses grants that match 59 percent of actual NHI benefits (net of the EGYO). Municipalities contribute amounts to the program that in aggregate equal the total amount of the CSP grants. For benefits below 800,000 yen per receipt, the municipal share of the contribution is set at the average value of the municipal share of NHI enrollments and NHI benefits (net of the EGYO). For benefits above 800,000 yen (i.e., catastrophic expenses), the municipal share is simply the municipal share of NHI benefits.

Third, the central and prefectural governments provide subsidies from their general budgets. The central government subsidies include the Medical Benefit Subsidy (a grant corresponding to 32 percent of NHI benefits) and the CSP Subsidy (a grant corresponding to 25 percent of municipal contributions to the CSP). The central government also allocates funds corresponding to nine percent of the total NHI benefits to the Adjustment Grant (AG), which addresses fiscal disparities among municipalities. The prefectural subsidies parallel their central government counterparts with a grant corresponding to 25 percent of municipal CSP contributions and a prefectural version of the AG that allocates funds equivalent to nine percent of the benefits aggregated at the prefectural level.

Lastly, municipalities make intra-municipal transfers from their general accounts to their NHI special accounts. Such transfers consist of two types. One is statutory; set by national laws, it compensates for revenue losses due to premium reductions for the poor, and benefit increases caused by special circumstances that municipalities cannot control. The other is discretionary. Such transfers arguably function as ex-post subsidies that make up deficits when other types of funding, including increasing premiums, are not available.

2.3. Fiscal Disparities and Compromise in Horizontal Equity

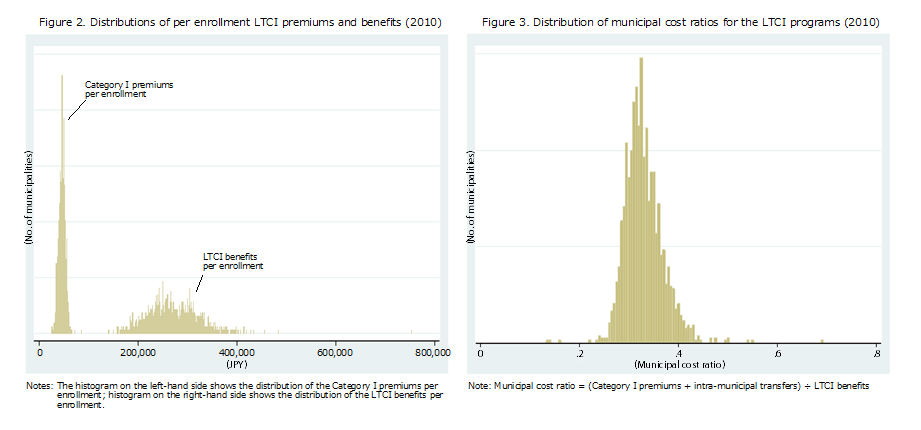

Figure 1 shows the distribution of premiums and benefits per enrollment for each municipality in 2010. As this figure shows, significant fiscal disparities still exist among municipalities, and the system of fiscal transfers is not sufficient to address the uneven spatial distribution of the unhealthy and the poor among municipalities. Kitaura (2007) examined the issue of disparities among NHI programs by laboriously calculating annual premiums for a couple with identical income in every municipality. He showed that the premiums for a couple with a typical annual income for the elderly (2.3 million yen) would range from around 60,000 to 400,000 yen depending on the municipality. This clearly demonstrates that horizontal equity among NHI programs is significantly compromised.

Another problem with the NHI is the size of its individual programs. Many municipalities are too small to pool risk. In 2010, half of all municipalities had less than 7,800 enrollments, and a quarter had less than 3,100. In small municipalities, we may readily predict unexpected hikes in NHI benefits. Such hikes have to be covered either by an increase in premiums or ex-post intra-municipal transfers from the municipal general account. Since an increase in the premiums is usually avoided, this leads to a further increase in intra-municipal transfers, imposing further restrictions on municipal expenditures in general budgets.

Given these concerns, the central government is trying to integrate municipal NHI programs at the prefectural level. In fact, the prefectural cost-sharing program previously only matched medical costs in excess of 300,000 yen per receipt before 2015, but now matches all cost ranges. Furthermore, starting in 2018, prefectures will involve themselves more directly in NHI programs by distributing the cost of NHI benefits among municipalities. Each municipality will contribute the specified amount to the prefectural administration, which will then finance the NHI benefits. This new system may smooth disparities and ease the fluctuation of current NHI expenses among municipalities. Nevertheless, it will not help to solve the disparities among prefectures. Furthermore, since municipalities will still decide their own premiums based on their allocated costs, the system will not effectively respond to the issue of horizontal equity in premium-setting either.

3. Long-term Care Insurance: Description of the System and Current Issues

3.1. Long-term Care Benefits

The LTCI covers persons aged 65 and over (Category I) and persons aged 40-64 (Category II). To receive LTCI benefits, prospective recipients have their needs assessed by their municipality of residence. The eligible are classified into seven stages according to the severity of their LTC needs, consisting of two stages of Support Required (SR1 and SR2) for the least severe, and five stages of Care Required (CR), from 1 to 5, with 5 being the most severe. The eligible are entitled to “purchase” LTC services from providers of their choice with co-payments amounting to 10 percent of the actual cost (i.e. the LTCI benefit covers 90 percent of the expense). Benefits are available up to a ceiling, the amount of which increases according to the seven stages of the severity of individual needs. The benefits for Category II are restricted to some specific age-related diseases. In addition, those classified in SR1 and SR2 are not eligible for institutional care. The beneficiaries, if they desire, can self-finance additional services.

3.2. How Are LTCI Programs Financed?

The LTCI is another residence-based scheme managed by municipalities. Through their LTCI special accounts, municipalities finance LTCI benefits, as with NHI benefits, out of premiums, cost-sharing schemes, transfers of funds from upper levels of government, and intra-municipal transfers. Municipal residents aged 65 years and over pay the Category I premiums to their municipalities. The rate structure is progressive. It is defined as “an adjustment value ´ a standard rate,” with the adjustment value being larger for higher income households. While the central government sets out the adjustment values, municipalities set the standard rates. When setting this rate, they forecast their LTCI benefits and revenues for a three-year period, termed the Program Management Period. In particular, they set the standard rate such that Category I premiums balance their three-year budget.

Since the local premiums are not sufficient to finance LTCI benefits, as in the case of the NHI, various layers of transfers of funds provide fiscal assistance to municipal LTCI programs. First, Category II premiums paid by individuals aged 40-64 are pooled in a national fund and then allocated to municipal programs. This grant, called the Fee Payment Fund Grant, matches 28 percent of LTCI benefits. It thus works as an equalizing device, as it favors municipalities in which the Category II share is smaller and LTCI benefits are larger.

Second, there are two prefecture-wide schemes of cost-sharing. One is the Mutual Stabilization Program, the intention of which is to equalize and stabilize municipal LTCI revenues. The other is the Fiscal Stabilization Fund (FSF). Prefectures pool contributions made by municipalities (subsidized by prefectural governments and the central government) to the FSF, and then use the pool to finance FSF grants or loans to provide fiscal assistance to municipalities that are hit by unexpected revenue losses.

Third, the central and prefectural governments disburse subsidies out of their budgets. Central government subsidies include the Long-term Care Benefits Subsidy, which matches 20 (15) percent of in-home (institutional) care benefits, and the Adjustment Subsidy (AS), which allocates central government funds equivalent to five percent of the national total of all LTCI benefits. The latter aims to equalize municipal Category I premiums across municipalities, allowing for the percentage of those aged 75 years and over (i.e., LTC needs), and the average income of those aged 65 and over (i.e., premium bases). At the same time, prefectures cover 12.5 (17.5) percent of in-home (institutional) care benefits in their jurisdictions through the Cost-sharing Subsidy.

Finally, another 12.5 percent of benefits is financed by intra-municipal transfers from the general account to the LTCI special account within a municipality. It should be noted that, unlike the NHI, municipalities are not allowed to make ex-post intra-municipal transfers to cover deficits in the LTCI special account.

3.3. Fiscal Disparities and Municipal Incentives to Limit the LTCI benefits

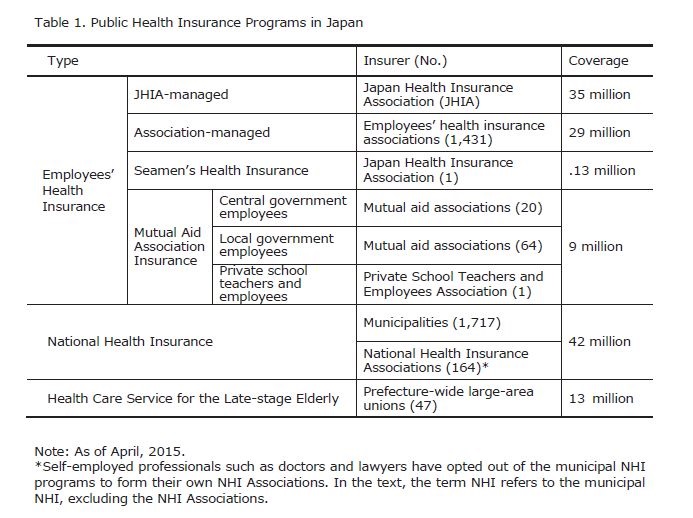

Figure 2 shows the distribution of LTCI premiums and benefits per enrollment. Despite the equalizing effects of the transfers mentioned above, premiums and benefits differ among municipalities. While the spread of the disparities is smaller than in the case of the NHI, they still reflect an uneven spatial distribution of the less healthy and the poor among those aged 65 and older. This also implies that horizontal equity is compromised in LTCI programs just as it is in NHI programs.

Another problem associated with the LTCI is that municipalities may face incentives to restrict LTCI benefits. Given the mechanism for budgeting LTCI expenditures discussed above, increases in LTCI benefits result in corresponding increases in local burdens (i.e., Category I premiums plus intra-municipal transfers) to the extent that the system of transfers fails to offset the increase in benefits. While Hayashi (2012) shows that the offsetting effect of the transfer system is substantial on average, this may not be the case for municipalities with smaller populations, or for municipalities with a large proportion of local costs (i.e., municipalities in the upper tail of Figure 3). This may result in two types of adverse effect, as described below.

First, there may be an incentive for municipalities to control demand for LCT services. Because municipalities conduct assessments of the eligibility of LTCI applicants, they may assess the LTC needs of the applicants downward in order to control increases in LTCI benefits. Hayashi and Kazama (2008) provide corroboration for this adverse effect, showing that municipalities with more stringent fiscal climates display a greater tendency to reject applications for LTCI benefits. Second, there may also be an incentive for municipalities to restrict the supply of LCT services. Providers of LTC services can be private or public. If they are private, it is municipalities which grant permission for their operation when they operate within single municipal boundaries. In addition, municipalities sometimes provide institutional LTC services themselves. Unlike NHI programs, therefore, municipalities have ample opportunity to control the supply of LTC services, especially in the case of institutional LTC services. Focusing on this incentive aspect, Hatta (2015) argues that municipalities tend to limit the size of institutional LTC services in an attempt to exclude the elderly from their jurisdictions. This is because a growing elderly population would lead to an increased local burden in terms of the LTCI and NHI budgets, especially for small municipalities in rural areas. Hatta also argues that rural municipalities that adopt this type of “policy of exclusion” would contribute to an inefficient resource allocation, given that they are likely to possess a comparative advantage in providing institutional LTC services because of their low land prices. In addition, they forgo opportunities to increase local employment with increased LTC service provision.

4. Concluding remark

Given the institutional complexities of the NHI and the LTCI, and their significance for local public finance in an aging Japan, the present space is too limited to properly delineate the problems and future prospects of Japan’s two residence-based systems of social insurance. There is also unfortunately no single reference that could provide a comprehensive overview of these topics. Readers may nevertheless obtain some useful information from Olivares-Tirado and Tamiya (2014), concerning the LTCI programs, and Mochida (2008), concerning local public finance in Japan.

<References>

- Olivares-Tirado, R., Tamiya, N., 2014. Trends and Factors in Japan’s Long-Term Care Insurance System. Springer.

- Mochida, N., 2008. Fiscal Decentralization and Local Public Finance in Japan. Routledge.

- Hatta, T., 2015. Chiho Sosei saku wo tou (ge): Iju no shogai teppai koso senketsu [On the Chiho-Sosei policy (part II): The priority is removing barriers to internal migration] Nihon Keizai Shimbun, Morning Edition, 2015/02/06.

- Hayashi, M., 2012. Channels of stabilization in a system of local public health insurance: the case of the National Health Insurance in Japan. CIRJE-F-847, Faculty of Economics, University of Tokyo.

- Hayashi, M., Kazama, H., 2008. Horizontal equity or gatekeeping? Fiscal effects on eligibility assessments for long-term care insurance programs in Japan (with H. Kazama). Asia-Pacific Journal of Accounting and Economics 15(3), 257-276, 2008.

- Kitaura, Y., 2007. Kenko hokenryo (zei) no suiheiteki fubyodosei [Horizontal equity in the National Health Insurance Premiums]. KISER Discussion Paper Series No.8, 2007/9.