Unit 05-A: Issues of Intergovernmental Fiscal Transfer in relation to Fiscal Decentralization

Unit 05-A: Issues of Intergovernmental Fiscal Transfer in relation to Fiscal Decentralization

Wataru Kobayashi

Associate Professor

Faculty of Policy Informatics, Chiba University of Commerce

1.Introduction

Discussion of fiscal decentralization eventually arrives at the question of the allocation of functions and the allocation of fiscal resources. The former involves the question of what role local public authorities (local governments) should play, and the latter the question of how fiscal resources should be allocated in relation to these roles.

Traditionally, discussion of the allocation of functions between governments has classified the roles of the governments based on the concept of the three functions of public finance, and, in relation to the function of allocation of resources, has considered allocation by local governments as the most efficient means of provision of local public goods (“the decentralization theorem”). However, when we take externality and disparities in fiscal capability between regions into consideration, issues in relation to an absolute reliance on local governments for the provision of local public goods become apparent, suggesting the need for the apportioning of specific roles in intergovernmental fiscal transfers1).

In Japan, the local allocation tax and national treasury disbursements are positioned as representative systems for the transfer of public finance between administrations. The former are general grants, the use of which is not specified, while the latter are special grants for specified purposes. The local allocation tax is considered to have two functions, the guarantee of fiscal resources and fiscal equalization; national treasury disbursements also play a role in the function of guaranteeing fiscal resources. Intergovernmental fiscal transfers raise numerous issues; this paper will consider three issues related to the two functions indicated above.

1)This discussion of the allocation of functions between governments based on the three functions of public finance and expected roles in intergovernmental fiscal transfers is

based on Oates (1972).

2. The Guarantee of Fiscal Resources: Significance and Level

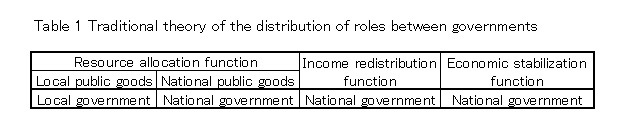

The first issue to be considered is the significance and level of the guarantee of fiscal resources. The major point of contention in discussion of the significance of the guarantee of fiscal resources is whether the system in which the national government requires work from local governments should be continued. According to the traditional view of the distribution of functions shown in Table 1, in addition to supplying national public goods, the national government should also fulfill an income redistribution function and an economic stabilization function. The problem is whether, in fulfilling these functions, it is desirable for the national government to create local agencies in regional areas and assign national public servants to perform the relevant duties, or whether the performance of the functions should be entrusted to local governments and undertaken by local public servants. This is an issue that should be given prudent consideration in each field of administration2).

With regard to the level of the guarantee of fiscal resources, it will be necessary to examine a number of fundamental approaches: Should essential expenses be guaranteed unconditionally; should the government guarantee essential expenses after local governments have undertaken standard measures for the reduction of costs, or should essential expenses be guaranteed after the most extensive cost-cutting measures able to be conceived have been implemented? While an unconditional guarantee of resources raises concerns over potential blowouts in local government expenses, a guarantee of the minimum essential resources produces concerns over shortfalls in fiscal resources, and fiscal disparities between regions generating disparities in terms of citizen welfare. Considered from this perspective, the provision of fiscal resources based on standard cost-cutting measures seems the ideal choice, but the issue here is how to define, and how to measure, essential expenses with standard cost-cutting measures as a precondition.

Ordinary local allocation tax, which represents more than 90% of the total of local allocation tax, is allocated to the figure remaining when standard fiscal revenue is subtracted from standard fiscal demand (i.e., it is equivalent to the shortfall in fiscal resources). The function of the local allocation tax in guaranteeing fiscal resources is actualized by means of this calculation method. As a mechanism to make it possible to project fiscal demand as accurately as possible while preventing increases in expenses, variables which it is difficult for local governments to manipulate at their own discretion (population, area, etc.) are the fundamental units of measurement, and these are multiplied by unit expenses calculated from standard expenses (projected expenditure by local governments providing for standard eventualities) and correction factors taking into consideration the status of individual local governments.

In addition, a “top-runner” system was introduced in fiscal 2016. Under this system, expenditure by local governments which have controlled their expenses by means of the use of outsourcing or the introduction of the “designated manager system” for certain areas of their duties is reflected in the calculation of total expenses. This can be interpreted as a partial transition from a guarantee of standard fiscal resources to a guarantee of the minimum fiscal resources. However, in evaluating this system, it will be essential to consider how the appropriate level of guaranteed resources is conceptualized, and what degree of financial disparity between regions is allowable.

2)The issue of spillover of local public goods is also an important point for discussion. This refers to the problem of the benefit of local public goods provided to a specific region

spreading to another region. The fact that a local government is an entity which has an interest in and responsibility for the welfare of the residents of its region, and does not

consider external benefit extending to other regions may result in the provision of an insufficient level of public goods by the local government. One method of responding to

this issue is to provide incentives via percentage grants. However, because the level of external benefit differs for each project or service, calculation of the appropriate grant

rate is difficult. There remains room for discussion as to whether an average grant rate should be set and the remainder left up to the judgment of the relevant municipality,

or whether the national government should formulate a basic plan and assume a leadership role.

3. Fiscal Capability: Definition and Indicators

The second issue for consideration is the definition of fiscal capability and the determination of indicators for this parameter. The fiscal equalization function of the local allocation tax primarily equalizes disparities in fiscal capability between localities3), and can be interpreted as a means of equalizing disparities in demand and disparities in revenue based on the standard local allocation tax discussed above. The higher the regional revenue, chiefly sourced from local taxes, the lower the allocation tax; the higher the fiscal demand, i.e. the higher the essential expenses, the higher the local allocation tax.

Based on this perspective, it would be natural to assume that fiscal capability can be defined as the level of fiscal revenue in relation to fiscal demand. In fact, in Japan’s local government finance system, the three-year average of the figure obtained by dividing the standard fiscal revenue by standard fiscal demand is defined as the fiscal capability index, and is employed as an indicator of the fiscal capability of local governments. However, there are differing opinions as to whether to include fiscal demand in the definition of fiscal capability, or to recognize disparity in demand (disparity in costs) as part of the disparity in fiscal capability which is to be equalized. In attempting to gain an accurate understanding of fiscal demand, a system in which actual expenses or scheduled expenses are allocated separately to each local government may be considered, but the amount received in the allocation would increase by the amount expended for the operation of the system, generating the possibility of an increase in expenses. This issue is similar to the point of contention regarding the level for the guarantee of fiscal resources.

At the same time, even if fiscal capability were to be defined based exclusively on fiscal revenue, the figure would normally be divided by population. Division by population can be considered to provide an objective indicator of the fiscal scale of the local government in question, and it is possible to perceive an awareness of fiscal demand in the background. When defining fiscal capability, it is therefore not possible to ignore fiscal demand, but it is also not absolutely necessary for the indicator which expresses true fiscal capability and the fiscal capability which is the subject of the fiscal equalization system to be the same. Even if the fiscal capability which is the subject of the fiscal equalization system diverges from true fiscal capability, if this is the result of a measure to prevent an increase in expenses, the system can be considered to be rational.

3)The fiscal equalization function of the local allocation tax system can also be considered in terms of vertical fiscal equalization, which equalizes the fiscal gap between the

national government and local governments, and horizontal fiscal equalization, which equalizes the disparities in fiscal capability between local governments.

4. Positioning of Local Governments not receiving Allocation Tax Grants

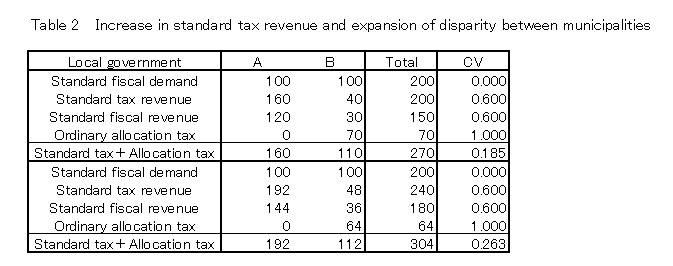

The third issue is the positioning of local governments not receiving allocation tax grants. These are local governments which do not receive the normal allocation tax grant because their standard fiscal revenue exceeds their standard fiscal demand. In a situation in which such local governments exist, disparities between regions expands conspicuously with an increase in local sources of tax revenue. Table 2 shows a simple numerical example of this phenomenon.

In Table 2, we assume the existence of two hypothetical local governments, A and B, the level of standard fiscal demand of each of which is designated as 100. Standard tax revenue is the tax revenue considered to be able to be obtained by the local government when the tax items specified by the Local Tax Act are levied at the standard taxation rate. Standard fiscal revenue is this amount multiplied by 0.754). When the amount determined by subtracting standard fiscal revenue from standard fiscal demand is positive, the ordinary allocation tax grant is the figure obtained; when the figure is negative, the ordinary allocation tax grant is zero. In the numerical example shown in Table 2, A is a local government which does not receive allocation tax grants. CV in the column at the right of the table is the coefficient of variance (standard deviation divided by the average value), which shows the magnitude of variation between the variables in each column (i.e., the magnitude of disparity between the local governments).

4)Some standard tax revenue is also factored into standard fiscal revenue on a 100% basis. The calculation of standard fiscal revenue based on standard tax revenue means

that taxes levied independently by the municipality (when it establishes taxes other than legally specified taxes or applies excess taxation at a higher rate than the standard

taxation rate) are not reflected in the calculation of the normal allocation tax. In other words, the system is designed to ensure that the local allocation tax does not decline

even if the municipality levies its own taxes, which would reduce the incentive for the levying of independent taxes.

The lower section of the table shows a scenario in which the standard taxation revenue of each administration increases by a factor of 1.2 against the upper section of the table. Because tax revenue increases by the same proportion for each municipality, there is no change in the coefficient of variance, but considered from the perspective of general fiscal resources including allocation tax (standard tax + local allocation tax), the coefficient of variance increases by approximately 40% (0.185 → 0.263). This is because in the case of the municipality receiving allocation tax grants, 75% of the increase in tax revenue is cancelled by a reduction in the amount of the grant, while in the case of the municipality which does not receive an allocation tax grant, the increase remains 100%, and this figure represents revenue for the municipality.

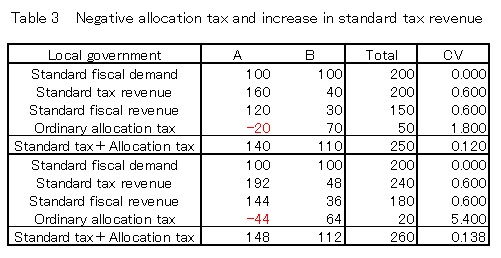

Table 3 shows a scenario in which standard fiscal revenue exceeds standard fiscal demand, and the difference (the excess amount of fiscal resources) is recorded as a negative allocation tax amount. In this scenario, the effect of increased tax revenue in increasing the disparity in ordinary fiscal resources is around 15% (0.120 → 0.138). According to the concept of a negative income tax, an individual whose taxable income fell below a minimum threshold would receive the difference as a grant from the government; under a system of negative allocation tax, a municipality recording a negative figure when standard fiscal revenue was subtracted from standard fiscal demand would pay the difference to the government.

Naturally, fierce opposition to the introduction of a negative allocation tax system could be expected from municipalities not receiving allocation tax grants. In order to resolve the issue by another means, it would be necessary to make all local governments recipients of allocation tax grants. This would necessitate measures to integrate part of the national treasury disbursement with the local allocation tax and increase the amount of standard fiscal demand, or to transform some local taxes into national taxes, and reduce standard fiscal revenue. The former, however, runs counter to the concept of separation of functions, which holds that the local allocation tax’s functions of guaranteeing fiscal resources and equalizing public finances should be kept separate5). In the background of the argument for the separation of functions in relation to intergovernmental fiscal transfers lies the sense that the integration of multiple functions in a special system would make the relative positioning of each specific system vague, leading to a lack of accountability. This is consistent with the point made in this paper that the significance of the guarantee of fiscal resources and the definition of fiscal capability should be reexamined. It will be necessary to give consideration to a number of issues, including the relative positioning of local governments which do not receive allocation tax grants.

The second of the measures mentioned above resembles a recent systemic reform in which part of the corporate inhabitant tax was made a national tax under the name of the local corporation tax6), but its purpose differs. In addition to reducing the uneven distribution of local tax by making the (significantly unevenly distributed) corporate inhabitant tax a national tax, the aim of this reform was to correct the expansion of disparities in fiscal capability between local governments not receiving allocation tax grants and local governments receiving allocation tax grants, as shown in Table 2, by increasing the local consumption tax rate. This would increase the relative weight of local consumption tax, which is very stable and is comparatively evenly distributed between regions. Nevertheless, the relative positioning of local governments which do not receive allocation tax grants in the fiscal equalization system remains an issue which should be examined prudently in considering the necessary future direction for Japan’s local taxation system.

5) For the concept of the separation of functions of the local allocation tax, see Sato (2011).

6) The local corporation tax has been applied since the business year commencing in October 2014.

<Reference>

- Oates, W.E. (1972) Fiscal Federalism, Harcourt Brace Jovanovich, Inc.

- Sato, Motohiro (2011) Chihozei kaikaku no keizaigaku (Economics of Local Tax Reform) (in Japanese), Nikkei Publishing Inc.